As financial advisors, we sometimes see mistakes in contributions to IRAs and Roth IRAs. While saving for your retirement is a good thing, you want to be mindful of the rules and doing it correctly.

An unfortunate mistake we see sometimes is people contributing towards IRAs and being fully aware that their deduction may not be eligible based on various reasons. Typically if one has a retirement plan at their job, that is the best place to get a tax-deduction because it is not contingent upon other factors like an IRA can be.

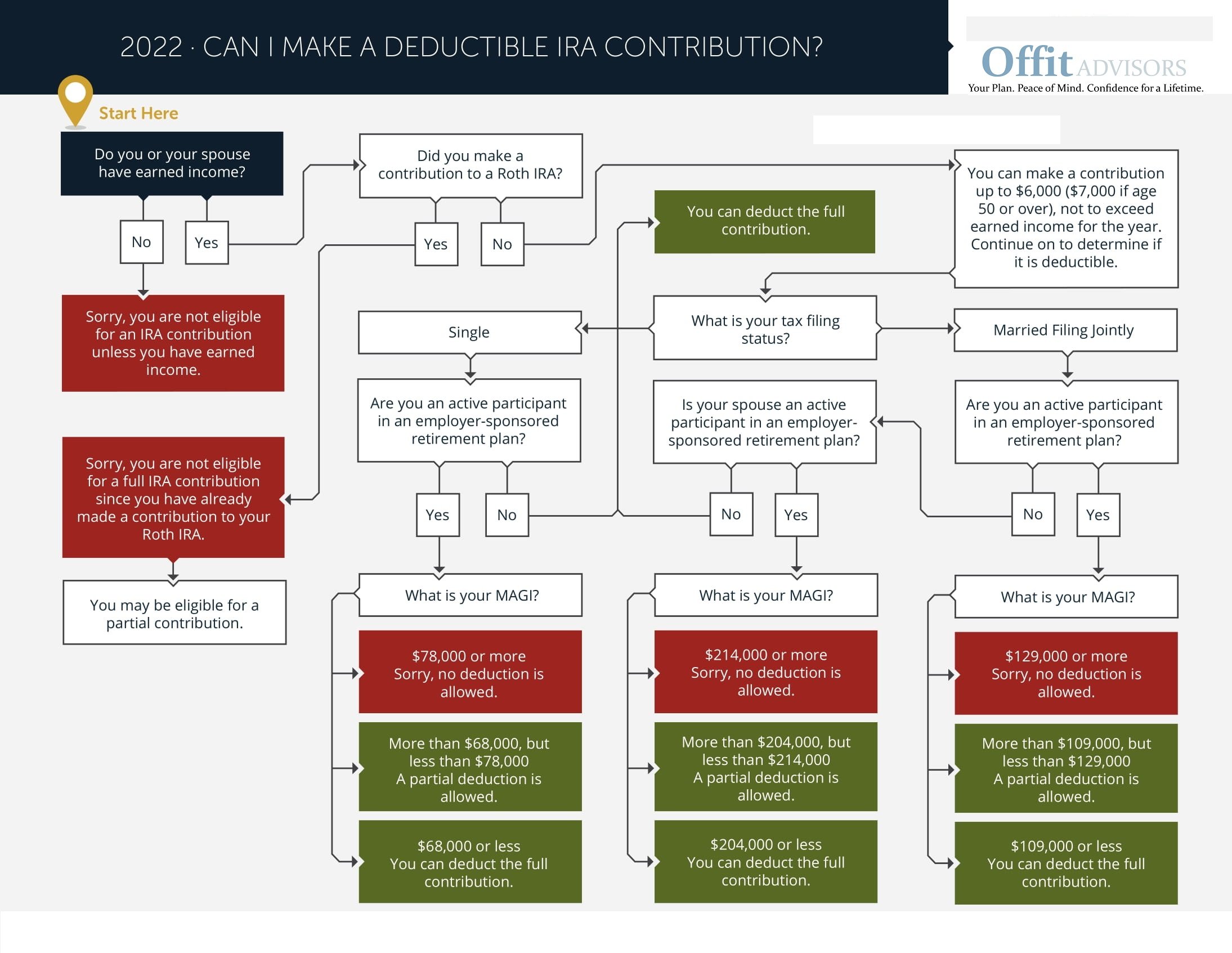

This chart can help explain the various paths to determine if your contribution is actually eligible for a deduction.