Hello Loyal Readership!

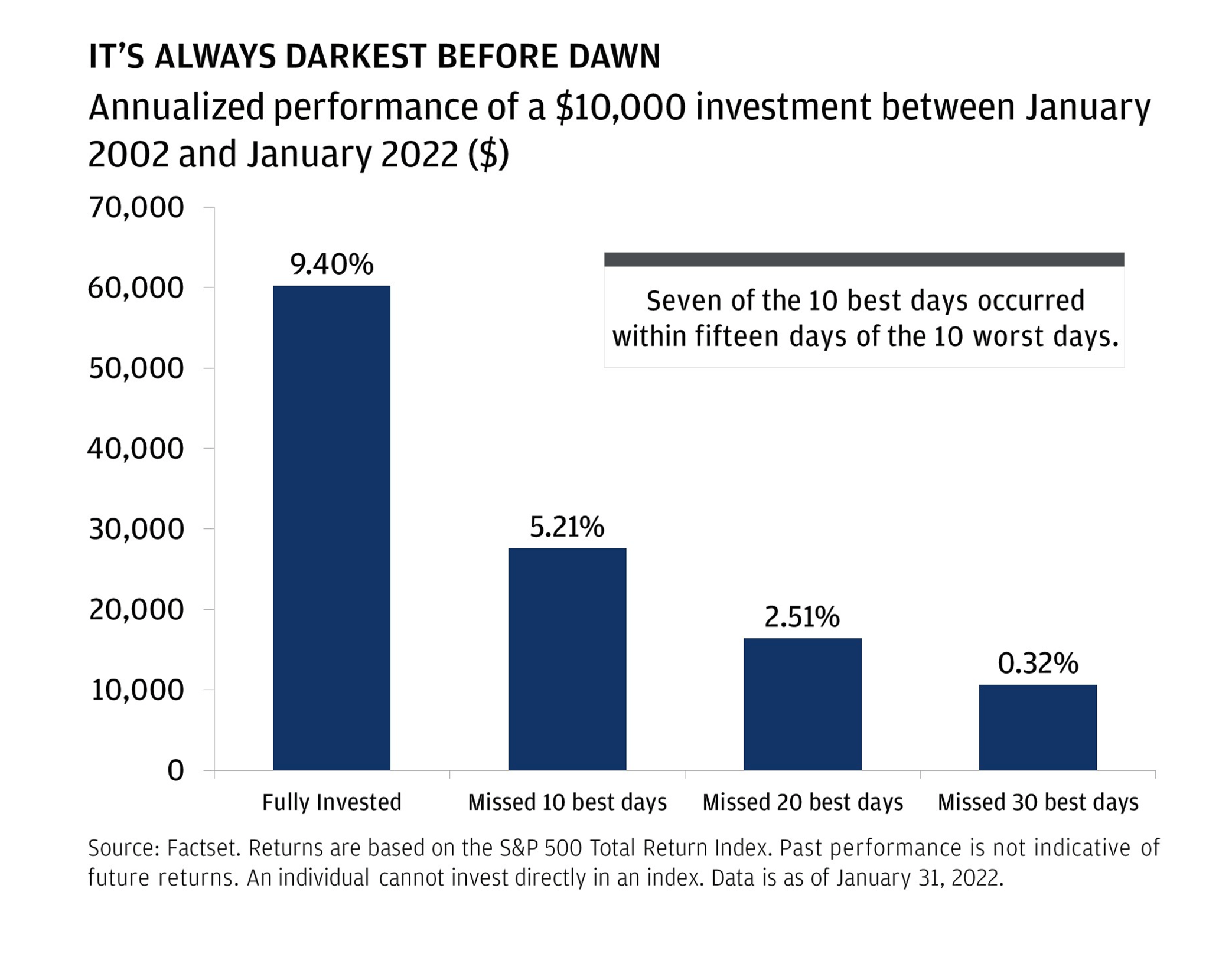

So far this year in January of 2022, we have seen share prices retreat and the S&P 500 has fallen for a few weeks before stabilizing, but we have seen speculative investments like Cryptocurrency, NFT’s and Meme stocks fall even further. Here are some thoughts about the current state of where things are today and may be moving forward.

Intrinsic Value vs. Non-Intrinsic Value

Intrinsic value? What the heck does that mean?

An important thing to remember here as part of this is that things like stocks, bonds, and real estate have real intrinsic value based on future earnings, while the speculative investments like crypto, NFTs, and meme stocks do not.

Intrinsic value means that you are investing something that is expected to have real future earnings. For example, if you are buying a stock, you are essentially buying ownership in a company that is expected to produce real revenues and profits for years to come based on the underlying business or service. For the speculative investments, they simply don’t have that. This would be the same if you are buying a business. You are buying a business that you feel has real value because it is expected that the business will have revenues and profits for years to come.

For investments without real intrinsic value, it is harder to manage volatility because their underlying value is not based on real or expected future earnings.

Rising Interest Rates

The Federal Reserve has scheduled some interest rate hikes in 2022 because when the economy is doing too well, they want to prevent inflation from running away to prevent things like housing or car prices from becoming unaffordable. When they do this, this can create some volatility in the market.

If interest rates rise, this can change the expected future earnings outcome for a business, or for a stock. For example, if a business had a loan at 3%, and now business moving forward will have a loan at 5% due to rising rates, this makes the cost of that loan higher and more expensive, and thus profits for the company lower. This can decrease expected future earnings, and thus create some more short-term volatility, but nonetheless, the market historically posts positive returns before and after these periods.

Market pullbacks

In 2021, the largest pull back in the market was only a 5% decline, and this can create complacency and overconfidence as people may feel that they can invest money in anything in the markets and it will work out. The market is actually in a normal state when it goes down frequently and often throughout the year, but people have been freaking out so far this year because we haven’t had pull backs in so long.

According to JP Morgan, the market averages a pull back of -14% on average each year, but despite that, 32 of the past 42 years in the market have ended up with positive returns. So, with the negative returns so far in 2022, it is ok and normal and doesn’t mean necessarily that this year won’t end up positively too. Market pull backs can actually be a good thing to allow for rebalancing one’s portfolio, tax-loss harvesting, and buying more shares at lesser prices – and for a disciplined investor a volatile market is where one can truly shine.

We hope this has been insightful and helpful for you. Looking forward to a great 2022!