|

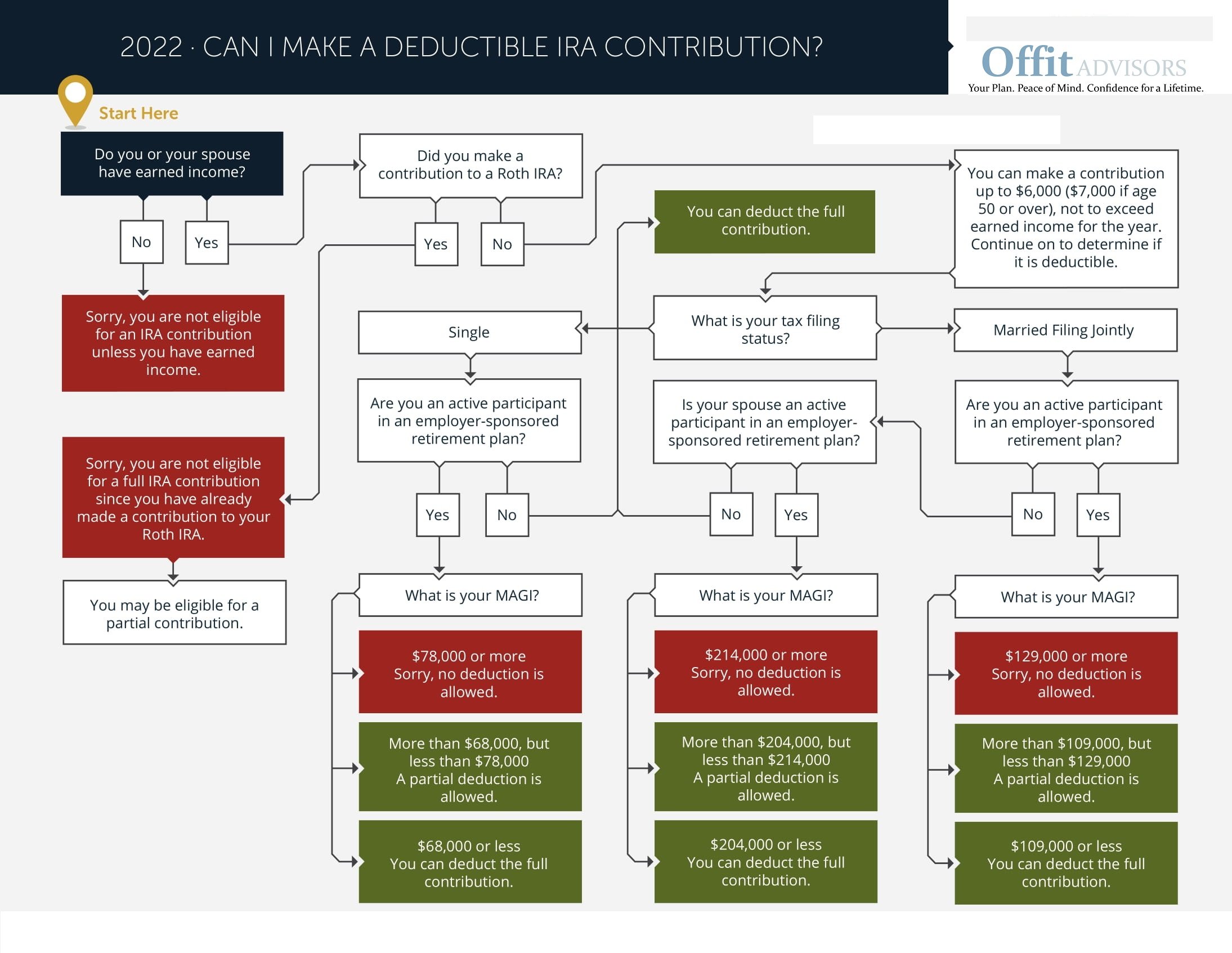

Can I Make a Deductible IRA Contribution?

As financial advisors, we sometimes see mistakes in contributions to IRAs and Roth IRAs. While saving for your retirement is a good thing, you want to be mindful of the rules and doing it correctly.

An unfortunate mistake we see sometimes is people contributing towards IRAs and being fully aware that their deduction may not be eligible based on various reasons. Typically if one has a retirement plan at their job, that is the best place to get a tax-deduction because it is not contingent upon other factors like an IRA can be.

This chart can help explain the various paths to determine if your contribution is actually eligible for a deduction.

Money and Your Financial Purpose

I have often seen some of the best financial planning clients – the ones who save and invest regularly, protect their assets, care about their futures and families, and are meticulous about being on track with their finances, and struggle to transition into retirement.

They have done a tremendous job and deserve credit for putting themselves in the fortunate financial position they are in. They have saved and lived within their means for so long, so starting to spend and use their money that they have accumulated feels so foreign to them. They aren’t necessarily depriving themselves, but they aren’t necessarily enjoying their position to the fullest either.

But the reality is that none of us will live forever, and everyone’s day will eventually come, and no one gets a reward for being the richest person in the graveyard. There are also many people who may have an underlying feeling or inkling as to what their purpose in life is or how they may want to use their money, but they don’t fully pursue it. I feel there are many people who are fortunately successful with their money, but they also need to be more successful in not missing their opportunity to live their lives and enjoy a life of significance, right now!

I believe part of my role as a Financial Planner and Advisor for clients is to help them utilize their money as a tool to help them enjoy life and realize their life’s purpose.

It’s their money, they have busted their butt to earn, save, and grow it, and as long as they are not jeopardizing their own financial security, they deserve to enjoy their money and utilize it towards fulfilling their life’s purpose today.

If one reaches the point of financial security and can afford to utilize their money, while not disrupting their financial independence, they should strive to take advantage of their position and look for daily opportunities to enjoy life, pursue their dreams, and live their purpose. For example:

If you want that extra tall coffee at Starbucks, go get it!

If you have always dreamed of going to Fiji, go now!

If you have always wanted to help your Son or Daughter launch a business idea that they have had but couldn’t afford to pursue it, help them now!

If you have always wanted to help end poverty or end cancer, do something about it today!

If you or someone you know may fit this description, please share that you have worked hard to climb up to the mountain top, and hopefully you have had a great guide or Advisor along the way to help you reach the Summit. Enjoy your journey along the way to the top, but also don’t forget to enjoy the view once you get there.

A Simple Truth; Stay Invested.

Hello Loyal Readership!,

Today I want to discuss some cliché but truthful facts about the market and keep it simple.

If we look back and we look forward, history has shown us that market continues to rise over time, but it is not a straight line, it is a wavy line. I fully expect this trend to continue in the future. Take a look at the graphic below illustrating various domestic, global, and economic events we have been through, but despite all of these unnerving moments the market continues to rise over time and someone who had invested $1 in the S&P 500 in 1970 would have $80 in 2021 just by staying invested.

A disciplined investor looks beyond the concerns of today to the long-term growth potential of markets.

The problem is most investors get in their own way. They see the current investment “apocalypse du jour” and react. This is not to not be sensitive to whatever the event that is going on – these are real events affecting people’s lives, but just not their long-term portfolio. For example, when oil prices quadrupled in the mid-70’s many investors were tempted to exit the market and “cut their losses”. But those that don’t get in their own way experience the gains that the market features by just saddling in and riding for the long term. As you can see in the graphic below, over the last 20 years, the “average investor” only received a 2.9% rate of return while the S%P 500 did 7.5%.

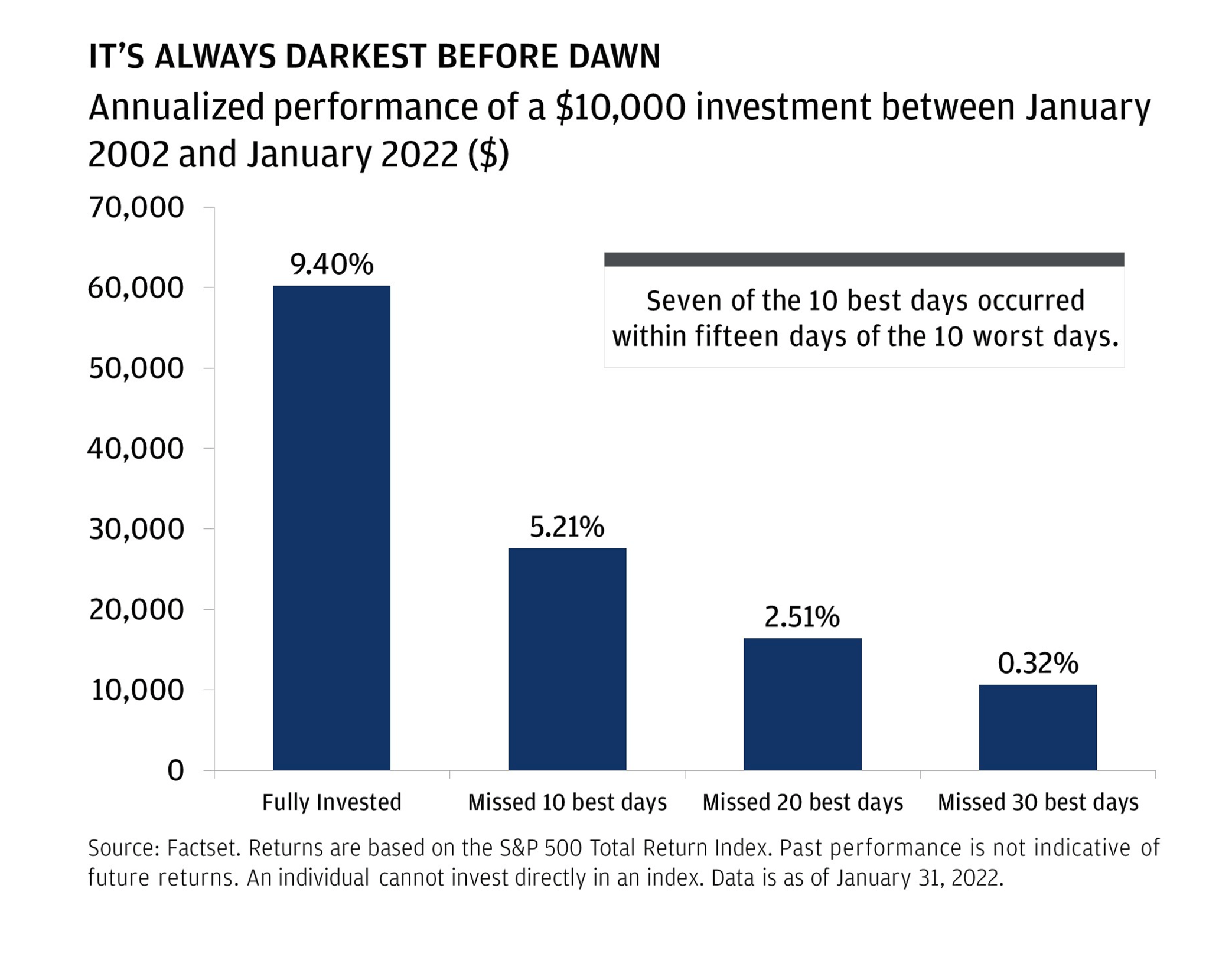

The final piece I want to share as to why you need to stay invested is because the best days occur without warning, often near the worst days. So if you ride out the worst days, you will subsequently closely capture the best days. But if you miss the best days, that has a lasting impact on your growth.

Stay invested. It’s a simple truth.

Taking Advantage of Market Volatility

Hello Loyal Readership!

I hope this message finds you well today. I know that no one enjoys the volatile periods of market, but if looked at through a different perspective, once can actually use this to your possible positive financial planning advantage!

Here are some of the top to tips to consider in a down financial market, AKA – right now!

1. Roth IRA conversion – if you have the opportunity to convert some of your pre-tax accounts into post-tax accounts and pay the tax now, but never pay the tax again, this could be an opportune time to do it. If you do it today, and convert now with lower values in your portfolio, you would pay tax on a lesser dollar amount today in exchange for a future earnings on your portfolio to never be taxed again.

2. Tax loss harvesting – if you have a non-qualified (non-retirement account) you can sell out some of your holdings that may have taxable losses and buy something similar but not the same and put a loss on your tax return. This can help you offset any positive gains in your portfolio that you would otherwise have to pay tax on.

3. Rebalance your portfolio – sell what may be high in your portfolio and buy back into what is low ie. If the designed allocation on your portfolio featured 80% stocks and now stocks represent only 62% of your portfolio, you can rebalance now instead of waiting

4. Contribute and invest more now! – with market values being lower today than they were just weeks ago, this is a buying opportunity to buy securities at a discount and “on sale”. Who doesn’t like to buy things on sale?

5. Appreciate the value of being diversified – over recent years with the S&P 500 and tech stocks being the top performing asset classes, people would say there are no need to own other asset classes. The value of having a broadly diversified portfolio with other aspects to diversification is being demonstrated now. For example, energy was one of the worst performing asset classes of the last decade, but this year it is the biggest winner. If you have a diversified portfolio there can be segments that do better than others in different market cycles.

7. Non-market correlated assets – there is value to having some parts of your overall wealth strategy in buckets that are non- market correlated – meaning that they don’t go down when the market goes down. This is especially true of those who are very near to approaching retirement.

7. Front- load, if you can – if you have the opportunity to put more into your 401k at your job or your IRAs or Roth IRAs, now is a great time do it. Why not put more in now when share prices are more on sale!

8. Speculative investment fads are showing they were just fads! – Crypto, NFTs, SPACs – we have said it here and will say it again most of these will go to zero. If you got caught up in the hype over the past couple of years, now may be a time to re-think and re-position your strategy now and moving forward.

If you found any of this helpful, or have questions about any of the above strategies, please let us know and we will be glad to help you.

Compounding Magic: Positive or negative?

We all hear a lot about how assets work for you while you sleep. That’s true. If you have money growing for you in a positive direction, you are making money on your money without doing anything and compounding can be magical.

For example, if you have $10,000 invested at a 6% growth rate, it can grow to over $18,000 in 10 years, and over $60,000 in 30 years!

To take it a step even further:

If you have $10,000 invested at a 9% growth rate, it can grow to over $24,000 in 10 years, and over $148,000 in 30 years!

But, the opposite is also true. Debts can work against you while you sleep and you need to pay off and avoid high cost debt as quickly as possible or “reverse compounding” can lead to financial ruin. In fact, 55% of Americans don’t pay the full amount of their credit card debt each month.

For example, if you have $10,000 of credit card debt growing at a invested at an 18% interest rate, and you pay the minimum payment of around $175 per month, you ultimately will end up paying $12,872 in interest over 10 years to pay it off, plus the $10,000 you originally owed, so the total is $22,872!

But, that is not the real total cost of credit card debt. Because, not only are you paying the original loan balance, and the interest, but you are also paying the opportunity cost of not having that money growing for you during that time like in the previous examples above!

So over a 10 year period, you are paying $22,872 with the loan balance and interest on the credit card, but also ultimately paying $24,000 in money could have gained if it was invested and growing at 9%. So the real cost of the $10,000 in credit card debt can total to $46,872!

Control debt before it controls you!

To expand upon this further, here are some simple tips to live by:

Before investing pay down high interest credit card debt. (unless you have the opportunity get a match in a retirement plan like a 401k – at least put in to capture that).

Establish an emergency reserve fund

Loved ones need money if you die – get some life insurance

Insure your ability to earn (disability insurance) and big assets (like your home)

Pay yourself first, investing in any plan with a match

Focus on your goals, not on keeping up with your friends

Invest part of every check, even if it’s a small amount

Diversify investments enough to ensure financial security

Start today!

Top 8 Estate Planning Goals for 2022

Today we are going to talk about the top goals for estate planning in 2022, but really in any year! And just a warning, I put a bunch of exclamation points below, but I promise I am not shouting, just trying to emphasize! Also, I am not an estate planning attorney but know good ones that can vouch for what I am saying below!

Put an estate plan in place! – this is important if you haven’t done it yet, get it started and have your wishes documented.

Sign your estate plan! – if you have created it but haven’t signed it, you need to do so! If your documents aren’t signed it’s as if you don’t have a plan at all! Also, you need to do this in front of a notary and two witnesses.

Review existing documents - make sure there are no changes needed for who you want to receive your assets or any law changes that may necessitate updates needed.

Review all of your accompanying documents – these are documents like your Health Care Power of Attorney, Financial Power of Attorney, Guardians of minor children – make sure they are all the same people you would want today. If you did your documents 10 years ago you may have elected someone else, but today that may be different, so make sure it’s reviewed and updated!

If you have established a Trust, make sure its funded! - a Trust is like a bucket and if you haven’t pointed things towards it to fund it with, you will be back to probate, and defeats the purpose of having a Trust in the first place. If you have a Trust and it doesn’t have assets to fund it, it’s like having an expensive piece of paper that won’t do anything for you.

Consider drafting a Letter of Instruction – for the person that you put in charge of your estate plan, you may want to give finer detail on your wishes and instructions. For example, you may want to list the the types of things you may want them to distribute assets to children for, where you might want your kids to go to school, etc. It’s not a legally binding document but it gives your agents direction as to what you would have done in that scenario and makes sure your wishes are fulfilled

Make sure your Fiduciaries know where you keep your documents! - They can’t use them if they don’t have a copy of them. So if the documents are in a safe – make sure they know where the safe is and the code or key to get in! Or if you are comfortable enough, you can send copies of your documents in advance to them now, so if something happens to you they already have a copy and don’t have to go searching for them later.

File a Gift Tax Return – in 2021, if you gifted any one person more than $15K as a single person or $30K as a married couple you need to file this. In 2022, the amount is $16K as a individual or $32K as a couple.