|

The Greatest Investment Risk

As I write this in October 2022, the market is down over 20% year to date and many investors are concerned, and rightfully so. Many clients and investors alike are asking, would I be better of just not investing and keeping cash?

Our opinion is that the market is forward-looking, not based on the present, and therefore it has already priced in what it expects to wrong. Therefore, the biggest risk is not that the S&P 500 will go down further, it is that it will one day, soon, rise and that you will have been out of it and missed it. The biggest risk is not being a participant in a 20% down market, it is not being a participant in a 100% up market. If you look at the history of the market and its best days, you will see that they cluster directly after a down market period, but missing any one or two of those days, could impact the growth of your portfolio.

Even missing one or two of those best days, can permanently cost you thousands of dollars in growth that you won’t make up. See chart below.

Therefore, if you are holding cash right now, waiting for the market to start coming back up to feel comfortable with investing again, I would say – deploy it and invest it right now and take advantage of this 20% sale/discount gif the market is giving you. The market always turns suddenly, and sharply, and nobody rings a bell with a warning as to when that is going to happen, so you need to be in the game, not on the sidelines to capture that.

Here are some other points relating to this:

Don’t run away from volatility – the key to success in a bear market is to have an investment strategy to manage the short-term volatility and to be able to continue to participate in the up market which is far more common, prevalent, and powerful than the bear market.

Don’t take too much stock in pundits, as no one knows what the stock market will do tomorrow or next week, so don’t pay attention to those pundits who tell you to bail out, telling you that you are naïve to stick with your plan. Great investors stay focused on the long term, and downside volatility is the price stock market investors pay for long term performance. There have been 26 bear markets since 1929, and all 26 have eventually given way to a bull market, and this one will be no different. Eventually.

View volatility as an opportunity – take advantage of the ability to buy discounted stocks while they are on sale.

The market is going to have a negative return about 1 in every 4 years. You can expect a drop of over 10% nearly every year. You can expect a drop of over 20% about every 5 years. Successful investors know this. If you can’t accept it, the stock market isn’t for you.

I hope this helps re-frame the paradigm as to how most investors look at the market into a more positive, and optimistic view that will serve you long term. Don’t follow the herd, lead the pack.

On It with Offit - September 2022

|

10 Steps to Become a Millionaire

Originally Published in Fulton Living Magazine

Americans can become millionaires in many ways – including real estate, business, inheritance, etc. However, I believe the surest path for most Americans is simply by saving and investing, and effectively using your company’s 401k plan. So here is a clear 10-step path to joining the ranks of America’s 401(k) millionaires:

Sign up for your 401k and do it TODAY.

If your company offers a match, ALWAYS contribute at least the full match, because it is an instant 100% rate of return. For example, to get a 3% match from the company, you need to contribute 3%, which is a 100% rate of return. Irrespective of market performance, the company is putting in for you the same amount that you are. ALWAYS CONTRIBUTE AT LEAST UP TO THE MATCH, it’s hard to beat from a rate of return perspective.

After you are putting in the minimum to capture the maximum match, save as much as you can. The only caveat here, is if you have other more important short-term priorities or financial obligations. For example, if you need to put extra money towards buying a new home, or medical expenses those may take priority. Or if you have high interest debt, like credit card debt at 15%, it may make more sense to pay that off before putting extra money into the 401k. Once those are paid off, redirect what you were paying towards those expenses or higher interest debt into the 401k!

Take 20 minutes to see if a Financial Planner or CPA can help determine if you are better off using a Roth 401k or a Traditional 401k – the difference in taxes between now and later can really make a difference.

Focus on your asset allocation and investment mix and start with a bias towards growth and stock allocation. Too many 401k investors hold far too much of their account in bonds, which should be kept to a minimum for those trying to accumulate long-term wealth. To get to millionaire status, you will need to be more of a stock owner, not a bond lender.

Don’t market time! Every time you get paid, invest each pay period, no matter what is happening in the markets! IGNORE THE NOISE! Don’t pay attention to the up and down movement of your account. Make automatic contributions each pay regardless of how the market is doing right now.

If you have the cash flow to do so, accelerate your contributions as early in the year as possible. For example, if your plan is to max out your 401k for the year, and you can do it in 6 months instead of 12 months, this gives your money more time to grow. However, before doing this, check with your HR representative to ensure that you won’t lose any of your company match by doing this.

Pay attention to costs of the funds and get familiar with the costs of each funds and have a bias towards lower cost funds.

Utilize funds that represent indexes. For example, you could incorporate funds that represent the S&P 500 index or International Indexes. Make sure you have diversification across the main asset classes – Large Cap, Mid Cap, Small Cap, International Developed Markets, International Emerging Markets, Real Estate, Commodities.

Wait until you reach full retirement age (at least 59.5 years old) to withdraw your funds, so you won’t pay a penalty for an early withdrawal. Let tax-deferred compounding work for you as long as possible!

If you follow these tips, for a few decades, it is almost certain you will become a millionaire!

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security.

On It with Offit - August 2022

|

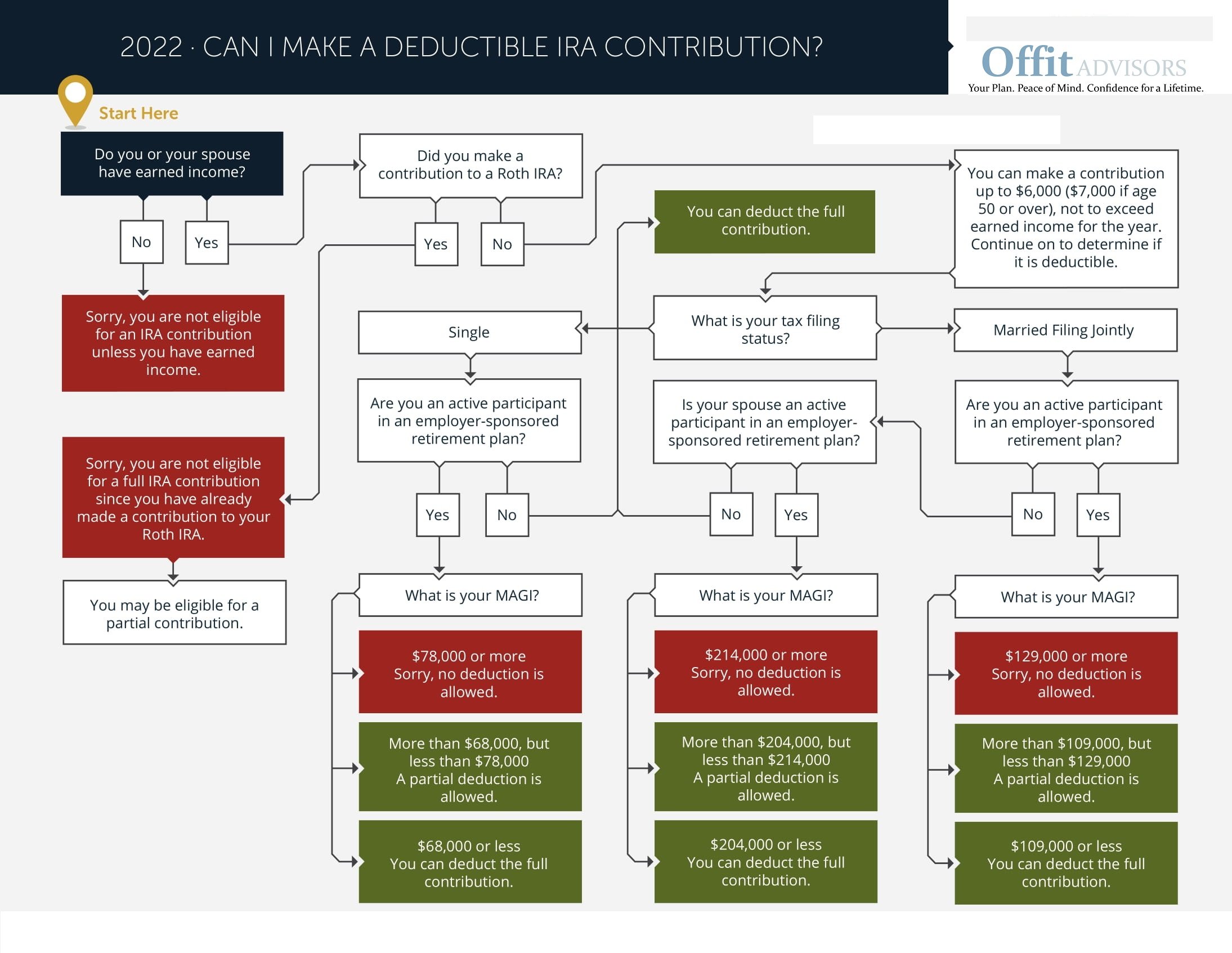

Can I Make a Deductible IRA Contribution?

As financial advisors, we sometimes see mistakes in contributions to IRAs and Roth IRAs. While saving for your retirement is a good thing, you want to be mindful of the rules and doing it correctly.

An unfortunate mistake we see sometimes is people contributing towards IRAs and being fully aware that their deduction may not be eligible based on various reasons. Typically if one has a retirement plan at their job, that is the best place to get a tax-deduction because it is not contingent upon other factors like an IRA can be.

This chart can help explain the various paths to determine if your contribution is actually eligible for a deduction.

Money and Your Financial Purpose

I have often seen some of the best financial planning clients – the ones who save and invest regularly, protect their assets, care about their futures and families, and are meticulous about being on track with their finances, and struggle to transition into retirement.

They have done a tremendous job and deserve credit for putting themselves in the fortunate financial position they are in. They have saved and lived within their means for so long, so starting to spend and use their money that they have accumulated feels so foreign to them. They aren’t necessarily depriving themselves, but they aren’t necessarily enjoying their position to the fullest either.

But the reality is that none of us will live forever, and everyone’s day will eventually come, and no one gets a reward for being the richest person in the graveyard. There are also many people who may have an underlying feeling or inkling as to what their purpose in life is or how they may want to use their money, but they don’t fully pursue it. I feel there are many people who are fortunately successful with their money, but they also need to be more successful in not missing their opportunity to live their lives and enjoy a life of significance, right now!

I believe part of my role as a Financial Planner and Advisor for clients is to help them utilize their money as a tool to help them enjoy life and realize their life’s purpose.

It’s their money, they have busted their butt to earn, save, and grow it, and as long as they are not jeopardizing their own financial security, they deserve to enjoy their money and utilize it towards fulfilling their life’s purpose today.

If one reaches the point of financial security and can afford to utilize their money, while not disrupting their financial independence, they should strive to take advantage of their position and look for daily opportunities to enjoy life, pursue their dreams, and live their purpose. For example:

If you want that extra tall coffee at Starbucks, go get it!

If you have always dreamed of going to Fiji, go now!

If you have always wanted to help your Son or Daughter launch a business idea that they have had but couldn’t afford to pursue it, help them now!

If you have always wanted to help end poverty or end cancer, do something about it today!

If you or someone you know may fit this description, please share that you have worked hard to climb up to the mountain top, and hopefully you have had a great guide or Advisor along the way to help you reach the Summit. Enjoy your journey along the way to the top, but also don’t forget to enjoy the view once you get there.